Q2-2018

Edition Q2 2018

Welcome to the quarterly newsletter of SeaLink Capital Partners (SCP).

Four years into its term and with the next general elections less than a year away, the BJP is facing one of its toughest economic challenges – rising crude oil prices. While the government did make the most of the extended period of low prices by pushing through on its economic reform agenda, India’s strong dependence on oil imports is creating a rippling effect – financially and politically.

For businesses, the best laid plans and projections can sometimes not pan out quite as expected. What matters most at that point is an honest and constructive dialogue with key stakeholders. Rahul Sanghavi shares his thoughts below on the importance of establishing and maintaining trust in any partnership.

Entrepreneurs have often cited customer research as the trigger that helped them capitalize on a market opportunity. We believe it is just as important at the time of investment in a company – with insights that can help refine the business strategy and areas of focus for the future. Karthik Narayanaswamy shares his views on this subject in this newsletter.

Indian Economy – still strong but headwinds emerge

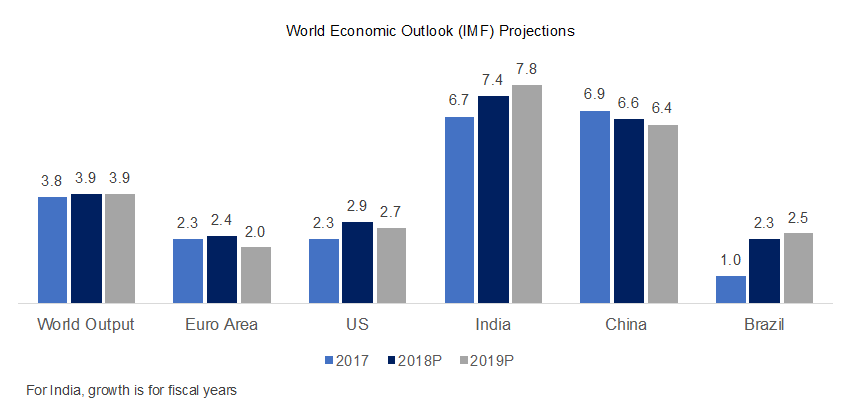

In its latest World Economic Outlook report, the International Monetary Fund has forecast a 7.4% GDP growth for India for FY 2018, firmly positioning it as the fastest growing major economy in the world. The report cites the “fading transitory effects” of demonetization and GST implementation, strong private consumption, and continued implementation of structural reforms that enhance productivity as the key factors behind their projections.

While India’s economic growth trajectory remains robust, headwinds have emerged. The increase in crude oil prices has widened the current account deficit and put additional pressure on the fiscal deficit while also stoking inflation concerns. With general elections less than twelve months away, the government may also face internal party resistance for passing on additional increases in fuel prices to the consumer.

India is the world’s third-largest consumer of oil and imports nearly 80% of its requirement, making it particularly susceptible to changes in global oil prices. The fiscal windfall it received over the past few years with low oil prices is currently reversing. Current account deficit is likely to reach a six-year high at over 2.4% of GDP. In the past years, India has funded its current account deficit with stable inflows from foreign direct investment. But with indications from the US Federal Reserve on imminent monetary tightening along with fears of a global trade war and increased protectionism, the risk of portfolio outflows has increased. While equity markets in India are performing well on the back on good earnings releases, bond yields have been rising as a result of fiscal concerns. The yield on the 10-year government bonds has risen from 6.41% in July 2017 to 7.74% in April 2018.

Issues in the banking sector persist – legacy problems of non-performing assets, combined with new oversight issues continue to impact credit growth. Recently, concerns related to governance at two of the largest private sector banks have also alarmed investors.

The slippage in fiscal deficit target and the increase in current account deficit has led to depreciation of the Indian Rupee. Since January 1 of this year, the Indian Rupee has shed 3% of its value vs. the US Dollar as opposed to a 6% appreciation in calendar 2017. Fortunately, a large foreign exchange reserve (US $426 billion) provides the Central Bank a cushion for absorbing any global shocks and the ability to withstand future pressure on the currency.

With inflation risks, the likelihood of further rate cuts in India has all but dissipated. The Central Bank will be paying close attention to the monsoon for upcoming monetary policy decisions. 70% of India’s annual precipitation comes between June and September, making the quantity and distribution of rainfall in that period crucial for keeping inflation of food items in check. The Meteorological department has forecast a normal monsoon for 2018 – critical to the farm sector which accounts for 15% of India’s GDP and employs close to half the country’s population.

On the positive side, consumer spending remains strong along with signs that private sector investing is recovering – both of which are crucial for India to meet its growth potential. Higher government spending in the farm sector and on infrastructure in rural areas is expected to continue to translate into higher consumption. Sales of entry-level motorcycles, for instance, are seeing the best growth they have had in several years. On the corporate side, the government’s recapitalization plan of $32 billion is also expected to provide a much needed boost to the lending capacity of public sector banks.

The importance of being earnest – in sharing bad news proactively

There will be times, before or after an investment has been made, when projections and targets are missed. In some instances, situations outside of the management’s control may have led to the miss. However, open, transparent and constructive communications are always in the control of the company and the investor.

As investors, we back management teams, not their business plans. What we value tremendously is the capability of teams to handle unforeseen circumstances with honesty and maturity.

Click here to read more.

Customer research – not just a “nice to have”

The due diligence period for a prospective investment is highly intensive for an investment team as they pore over company financials, engage in multiple rounds of discussions with the management team, peel the layers behind business model assumptions, scrutinize operations, and comb through legal documentation to identify any issues and gain comfort on moving ahead with the transaction. Amidst all the work, which is invariably conducted in a rather tight timeline, customer research doesn’t always surface to the top and is often conducted in a cursory manner, which undermines its usefulness.

At SeaLink Capital Partners (SCP), customer research is a crucial and non-negotiable due diligence component – one that is carefully conducted to identify areas of strength and future focus. Done correctly, we have found it to be very insightful in uncovering issues, validating hypotheses central to the investment thesis, and highlighting areas for value-creation and optimization going forward.

Click here to read more

News & Updates

SCP Analyst program

We’re hiring! SeaLink Capital Partners has a robust Analyst program to attract and develop high-quality talent.

As part of the program, which is uniquely designed as an apprenticeship, SCP Analysts get access to promoters, entrepreneurs and content experts in Indian industry while receiving direct exposure to senior investment and operating executives.

New Team Members

We are delighted to welcome Jasmine Makkar to the SCP team.

Jasmine joins us from EY where she was a Senior Associate in the investment banking team that focused on mergers & acquisitions in technology, media & entertainment. She has an MBA from SP Jain Institute of Management & Research and graduated in Economics from Lady Shri Ram College.