Q3-2018

Edition Q3 2018

Welcome to the quarterly newsletter from SeaLink Capital Partners (SCP).

The last quarter has been tumultuous in several ways for emerging markets, and India has not been an exception. With general elections less than six months away, the BJP-led government is facing some of its biggest challenges – economic, political and regulatory. The groundwork done on fiscal consolidation and structural reform over the last four year has paid dividends, as the government and the Reserve Bank are able to reach into their arsenal to address economic issues. Public sentiment and economic stability over the next few months will play a significant role in determining the outcome of the general election.

For organizations, the sentiment of their employees also determines both immediate and long-term success. Companies that are able to build and nurture a collaborative culture with a focus on innovation and continuous improvement create a major competitive advantage. We share our thoughts below on the importance of leading from the front when establishing a strong corporate culture.

India – A tale of two economies?

Prevailing commentary on India’s political and economic climate draws to mind the dramatic contrast beautifully elucidated in the opening paragraph of Dickens’ ‘A Tale of Two Cities.’ For some economic experts and political pundits, the current scenario is simply a launchpad to attractive new opportunities given the economic foundation and the underlying potential of the country. Others have been drawing parallels between the current scenario and the fragile state that the Indian economy found itself following the Global Financial crisis a few years ago. With national elections just over six months away, it is indeed a time of some hyperbole and uncertainty with a number of global and domestic factors at play.

The BJP (Bhartiya Janata Party) government, headed by Prime Minister Narendra Modi, is in the fifth and final year of its current term. National elections are due by May 2019. In the last elections, the BJP and its allies won a comprehensive mandate with electoral promises of reforms. Structural reforms have been delivered across the board – ranging from the rollout of the Goods and Services Act, bankruptcy code for faster resolutions, financial inclusion programs, infrastructure for digital payments, removal of certain restrictions for foreign investments, reduction of red tape for new businesses, public sector bank recapitalization and more. At the same time, fiscal prudence was prioritized; and aided in large part by benign oil prices; the government was able to rein in fiscal and current account deficits.

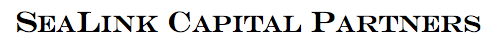

Growth continues to be robust and earlier this year, India overtook France to become the sixth largest economy. It also retained its position as the fastest growing major economy in the world by recording 8.2% GDP growth for the quarter ending June 2018.

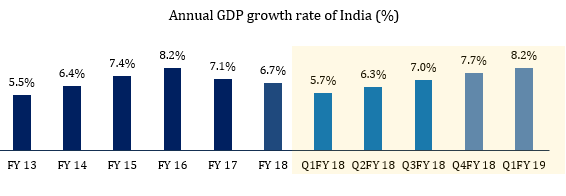

But there are looming shadows. The Indian Rupee, which demonstrated strong resilience throughout 2017, is currently at an all-time low against the US dollar, having fallen close to 15% in the year-to-date, with more than half that decline occurring after August 1st.

With 80% of its oil requirement imported, India is particularly sensitive to changes in oil prices. A weakening rupee along with an increase in global crude oil prices has been a double whammy for India’s import bill. The current account deficit is expected to widen to a 5-year high of 2.8% of GDP during the financial year.

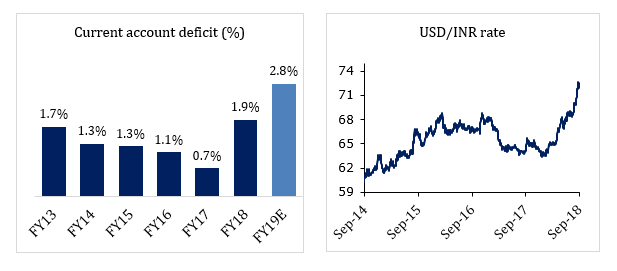

Most economists concur that external factors are largely responsible for the Rupee depreciation. Tightening of US monetary policy and the threat of global trade protectionism have created a flight to safety for capital, which has impacted emerging markets. From the Rupee’s perspective a vicious cycle has ensued –investors have pulled capital out of India which has placed downward pressure on the exchange rate, and consequently triggered additional selling by foreign investors. Since the start of 2018, foreign institutional investors have pulled out close to $2 billion

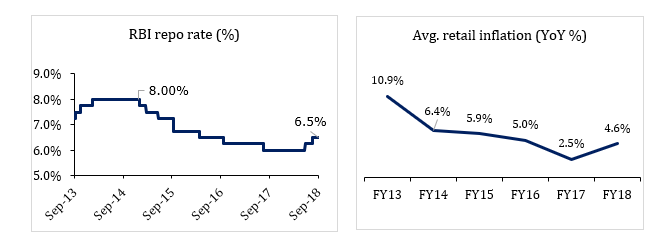

Inflationary risks from an uneven distribution of monsoon rains and a rise in minimum support prices for crops, along with a depreciating rupee and the narrowing interest rate differential have led the monetary policy committee (MPC) of the Reserve Bank of India (RBI) to increase the benchmark rate in two consecutive meetings, after a steady reduction over the last three years.

The banking sector is yet to emerge from the bad debt crisis, which hampered credit growth over the last few years. A new liquidity crisis has emerged for other shadow financial institutions (NBFCs) due to an asset-liability mismatch.

IL&FS, a leading Indian infrastructure development and finance company has defaulted on its obligations multiple times in the last couple of months. Widely considered to be a quasi-government entity with a AAA rating, short term paper issued by IL&FS was widely held across insurance companies and mutual fund houses. With combined debt across its subsidiaries of over Rs. 910 billion (US$12 billion), the fear of a domino effect from further defaults triggered a sell-off in equity markets in September particularly for NBFCs. The hardest hit have been housing finance, infrastructure finance and wholesale financing companies.

In a move to restore investor confidence and stem the contagion in the equity and debt markets, the government has stepped in to replace the IL&FS Board with a six-member panel led by Uday Kotak – a highly successful banker who has built a strong reputation for effective risk management.

To infuse liquidity into the system, the RBI has also announced that it would inject Rs. 360 billion (US $5 billion) via bond purchases in October. This follows a similar infusion in September and a relaxation of liquidity coverage ratios to ensure sufficient levels of currency in circulation during the upcoming festive season.

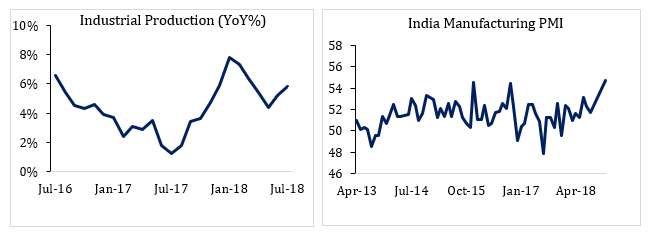

The ability of the government and the RBI to intervene and arrest negative developments comes from the platform of strong macroeconomic fundamentals in India. As mentioned earlier, growth remains robust. The government remains committed to fiscal prudence and the foreign exchange reserves held by the Central Bank remain at a very healthy level (over $400 billion), serving as a buffer against any external shocks. Consumer spending (as evidenced by same store sales growth and vehicle purchases) is growing; demand for retail loans is high and industrial production is also recovering after a lull. In its recent Global Macro outlook , Moody’s remains optimistic about India’s growth given the support extended by strong urban and rural demand and improvement in industrial capacity utilization.

This is also a period of uncertainty – both at the political and corporate levels.

There are leadership changes occurring at a number of private sector banks in India. ICICI Bank, Axis Bank, and Yes Bank are all in the midst of CEO transitions – with most of the departures being dictated by the RBI. The deputy CEO at HDFC Bank has also quit, putting succession planning into high gear. Unprecedented leadership changes happening at the same time when the financial system is recovering from the largest NPA crisis and reacting to the IL&FS crisis has impacted the equity markets. We have held the belief that valuations in India have far outpaced earnings growth over the past few years. This current macroeconomic situation may lead to potential investment opportunities at sensible valuations for investors.

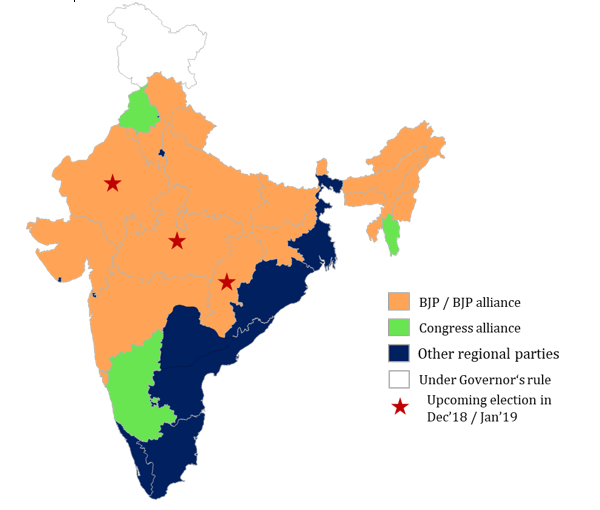

Election uncertainty is likely to impact markets and investor sentiment in coming months. In the 2014 elections, the BJP won a comfortable majority in the 572-seat lower house of parliament. Prior to that election, the BJP controlled the state governments of 7 out of the 29 states. Currently, the BJP or its alliance partners run the state governments in 19 Indian states, which represent close to the two-thirds of the country’s population – a much broader electoral support base, which if converted, could lead to continuity of the reform agenda that the government has initiated.

However, recent losses in the Karnataka state election and the collapse of alliances in Jammu & Kashmir and Andhra Pradesh have been political set-backs and suggest that the outcome for the 2019 general election is far from certain. Results of three upcoming state elections where the BJP is the incumbent will serve as a barometer of public sentiment going into the general elections.

The next chapter of the Indian growth story promises to remain interesting.

The importance of setting culture through role modeling

Instilling a strong culture means having a core set of values that the organization believes in and lives by on a daily basis. However, all too often these values get lost between the lines of a lofty mission statement, which itself is confined to a plaque on a wall somewhere in the hallways of the office.

Actions, we all know, speak much louder than words and for a desired culture to reflect across the organization, leaders need to be proactive and authentic in demonstrating the very values that they wish to see cultivated. In the absence of clear behavior from leadership, which is consistent with desired attributes, there can be “cultural silos” within the organization – making it misaligned at best and divisive at worst.

Click here to read more.

News & Updates

New Team Members

We are delighted to welcome Ishwar Prasad to the SCP team.

Ishwar joins us from McKinsey & Company where he was involved in several growth strategy and operation effectiveness projects across industries in India and the United States.

An avid tennis player, Ishwar holds a Bachelors of Technology in Mechanical Engineering from the Indian Institute of Technology, Delhi and has cleared levels 1 and 2 of the CFA certification.

SCP’s Fellowship Program

SeaLink Capital Partners also has a robust Fellowship program, which is uniquely designed as a 4-6 month apprenticeship.

We are excited to welcome Aditi Patil as our most recent SCP Fellow. Aditi has a master’s degree in finance from the London School of Economics and has been part of the Corporate Finance and Advisory team at Deloitte & Touche and the Investment banking division at Goldman Sachs. Following her fellowship with SCP, Aditi will be pursuing her MBA at INSEAD, France.