Q4-2017

Edition Q4 2017

Welcome to the quarterly newsletter of SeaLink Capital Partners (SCP).

The past year has seen game-changing reforms in the Indian economy including demonetization and the much-awaited rollout of the Goods and Services Tax (GST). While in the long run both of these initiatives are expected to result in a wider tax base and greater participation in the formal economy thereby increasing its overall size, they have caused short-term disruptions with liquidity shortages and production uncertainties.

Although GST and demonetization have grabbed headlines over the last year, they have been accompanied by other structural reforms such as a new bankruptcy law for faster resolutions, digitization drives for electronic payments, affordable housing schemes, and financial inclusion programs, which will all have multiplier effects through the economy. Most recently, the government has announced a $32 billion recapitalization plan for public sector banks to catalyze credit growth; and an ambitious $100 billion highway construction program to spur employment growth.

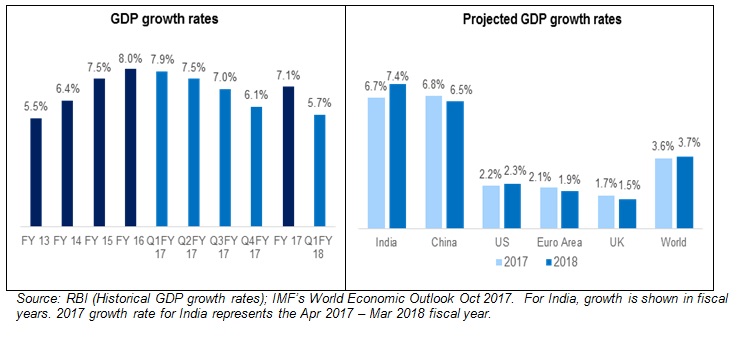

While the GDP growth rate has hit a bit of a hiccup in the last two quarters, we do believe that this relative slowdown is temporary and the fundamentals for sustained future growth have been put in place.

Sustainable growth for companies is just as important. Crucial components for growth are competitive advantages that stand the test of time and industry evolution. SCP believes that competitive advantages can never be static and that companies need to demonstrate agility and continuously develop new areas of differentiation for success. We’ve shared our views on this later in this newsletter.

GDP Growth: Strong fundamentals should support a revival

The headline GDP growth rate of 5.7% for the April – June 2017 quarter ignited a rather spirited debate on the impact of reforms and policy measures initiated by the Modi government over the last year.

While the quarterly GDP growth rate was at its lowest point in three years, most economists believe that it is not symptomatic of a structural issue but rather a transient impact of the destocking activities that were taken ahead of the GST implementation in July. A number of data sets point to increased activity post that period – the core Index of Industrial Production (IIP) saw a nearly 5% rise in August and service sector activity expanded in September. High frequency leading indicators such as automobile and two-wheeler sales have also seen an upturn, and the Reserve Bank of India (RBI) projects that economic growth will be north of 7% in the last two quarters of the year. The IMF, in its World Economic Outlook report, forecasts that while India and China will see similar growth rates in the current fiscal year, India will be the fastest-growing major economy in the world on the back of the structural reforms which will push growth above 8% in the medium term.

| It was nearly a year ago, when 86% of the currency in circulation was rendered defunct overnight. The final judgment on the effectiveness of the demonetization exercise is still out with loud arguments on either end. With 99% of the canceled currency deposited in banks, the opposition suggests that the quantum of “undeclared money” in the system was nowhere near the government’s estimate and that the proposed windfall to the central bank coffers has not happened. On the other side, the government argues that the demonetization exercise has significantly increased the overall tax net, which should lead to greater infrastructure spending, thereby boosting the economy, particularly in rural India. One intended consequence of demonetization was a shift towards cashless transactions. While the migration to cashless may have been coerced by reduced paper liquidity, the behavior change seems to have sustained to a large extent even after normalization of cash supply. Digital transactions increased by 23% in the six months following demonetization. This behavior change has been supported by government initiatives such as UPI (United Payments Interface) and BHIM (Bharat Interface for Money), which enable secure transfer of money through mobile telephones. With 1.16 billion mobile subscribers and 300 million smartphone users in India, the potential for electronic payment via mobile phones is significant. The push towards enhancing the use of technology remains at all levels. More than 1 billion Indians have been enrolled in Aadhaar (Universal ID) – the largest biometric identification program globally – which had been initiated by the prior administration and enables direct transfer of benefits. It is estimated that Aadhaar has saved the exchequer $9 billion by eliminating fraud and leakages. On July 1st, the Goods and Services Tax (GST) was rolled out supported by a technology infrastructure as the backbone. One of the main goals of GST is increasing tax compliance. A little over 100 days post roll-out, ten million taxpayers have registered as GST assessees (an expansion of nearly 30% over the past tax regime). There has also been an immediate and visible improvement in efficiency – average daily distance covered by a Goods carrier has risen from 225 km to nearly 325 km in just the first month post implementation of GST. |

| But the government is not taking any chances… While most macroeconomic indicators in India remain very strong (foreign exchange reserves and FDI inflows are at an all-time high; inflation and fiscal deficit are under control; exchange rate is stable), there remains the more serious “twin balance sheet” problem. Considerable debt on the balance sheets of corporates have forced them to curb investments; and at the same time, non-performing assets (NPAs) continue to plague the balance sheets of banks, hampering their ability to extend credit to borrowers. Credit growth at the end of September was 7% as compared to 10% a year ago, as banks remain reticent with new loans. Increasing access and affordability of credit is seen as an imperative to reviving sustainable growth. The cleanup of NPAs has been underway for a while with the RBI ordering lenders to refer debtors with bad debts to the nation’s insolvency courts. With a process outlined and priority assigned to these cases with the National Company Law Tribunal, there is a timeline for the resolution of these cases, which have been debilitating the lending capacity of banks for too long. In order to jump-start the investment cycle the government has announced a Rs. 2.1 trillion ($32 billion) recapitalization for Public sector banks over the next two years through a combination of bonds, budgetary support and equity raises. This recapitalization offers relief to the banking system that had been weighed down by stressed assets of nearly Rs. 10 trillion and provides a significant boost for future lending capacity. The countdown to the 2019 General elections has begun and with that the importance of a sustained growth revival with reforms focused on inclusive development has intensified. The Bharatiya Janata Party (BJP) performed well in state assembly polls earlier this year, but the party’s leaders are well aware that if they want to retain their position in the central government for another five years, evidence of a strong economic trajectory, accompanied by job growth, will be the litmus test for the electorate. Along with the bank recapitalization initiative, the government has also announced a Rs. 7 trillion ($100 billion) infrastructure project, which involves the construction of over 83,000 km of roads, highways, green-field expressways and bridges within the next five years. Beyond the economic growth from this investment, this program is expected to generate 142 million man-days of employment. While the government’s most recent investment announcements do provide a shot in the arm for boosting overall growth, there is some concern that it could come at the cost of fiscal discipline, which had been a focus of the last few years. Populist measures such as price capping for medical devices are also seen as detrimental to the long-term evolution of the industry in India. The BJP and its allies currently govern states that makeup over two-thirds of India’s population and over 60% of the GDP. They also dominate the lower house of Parliament making it relatively easy for bill passage. While they don’t have a majority in the upper house, current projections are that they should be near that by 2020. Should the government retain its mandate in the 2019 general election, the political stability will provide it ample runway to push forward its stated agenda of economic development. |

Public markets – increased liquidity driving up valuations

There have been robust liquidity flows into the Indian public markets from both domestic and foreign investors over the last year, driving up valuations even though corporate earning growth has been subdued. Post demonetization, domestic investors in particular, became cautious about investing in previously preferred asset classes such as real estate and gold, and moved their funds to the equity market. The net buying of equity shares by mutual funds in the four quarters post demonetization was four times the net amount purchased in the preceding comparable period.

The IPO market has also been very buoyant as an increased number of issuers aim to take advantage of the rally in the markets– for the first nine months of 2017 there were a total of 24 new public offerings as opposed to 15 for the same period in 2016. Collectively, the issue size in 2017 was Rs. 309 billion as compared to Rs. 194 billion in 2016. There is concern though that a market correction may be due soon, particularly if valuations are not supported by a rebound in corporate earnings growth in the current fiscal year.

Competitive Advantages: Making them sustainable

It is a discussion that happens often. We meet passionate and energetic management teams seeking growth capital to take their businesses to the next level. As we learn more about their business and their long-term vision for it, we ask them about their sustainable competitive advantage.

Very often we hear them describe advantages such as “first-mover”, “customer contracts”, and “superior technology”. But the question remains – which of these advantages is truly sustainable? Not just an advantage in the competitive landscape today, but one that they believe can be leveraged and sustained for the future. And, what is management’s plan to ensure that it is sustainable? Click here to read more.

News & Updates

SCP Analyst program

We’re hiring! SeaLink Capital Partners has a robust Analyst program to attract and develop high-quality talent. As part of the program, which is uniquely designed as an apprenticeship, SCP Analysts get access to promoters, entrepreneurs and content experts in Indian industry while receiving direct exposure to senior investment and operating executives.

In the past, SCP Analysts and Fellows (4-6 month position) have contributed significantly to the Firm while also gaining an opportunity to get hands-on experience in private equity investing in India.

Upcoming visits and conferences

We always welcome the opportunity to meet with entrepreneurs to learn more about their businesses and to provide our thoughts based on our experience in different sectors. Feel free to contact us at info@sealinkcap.com

Over the next quarter, SCP team members will be in the US and Europe. If you would like to hear more about SCP, or the investment climate in India, please let us know and we will be happy to set up a meeting.