Q2-2017

Edition Q2 2017

Welcome to the quarterly newsletter of SeaLink Capital Partners (SCP).

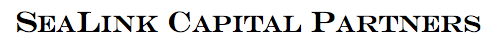

Later this month, the Narendra Modi-led administration will complete three years in office. Over the course of its tenure thus far, several economic indicators have significantly improved. Fundamentals of the Indian economy (fiscal deficit, current account deficit, foreign exchange reserves, foreign direct investments) are stronger than they have been in years, spurring long-term confidence with investors. Global factors have also aided some indicators such as inflation. We have taken a look below at the hits and misses of the administration as it approaches its third anniversary.

With the growing proliferation of news sources (authentic and otherwise), there is no dearth of available information on companies, business leaders and products/services. Over the last few years, companies have proactively invested in expanding capabilities in public relations and external communications to protect and bolster their images. However, investments in time and infrastructure for strengthening communication within organizations have been sporadic. SCP’s belief is that neglecting a strong and robust process for internal communications that builds trust and credibility within an organization can be very short-sighted. We’ve shared our views on this later in this newsletter.

Third year anniversary for a reforms driven government

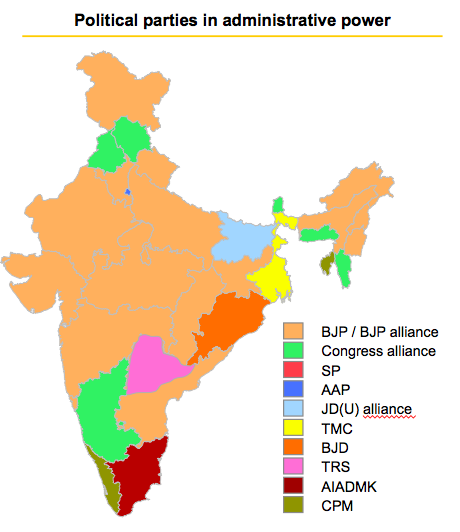

After being voted into power on a reform driven platform in 2014, the leadership of the Bharatiya Janata Party (BJP) made their intentions clear from the start.

The first two years were focused on laying the groundwork for sustained and inclusive growth. These included financial inclusion programs aimed at bringing the large unbanked population into the official credit system; banking sector reforms which included new licenses; budget deficit reduction through auctions in the coal, mining and telecom sectors; opening up of foreign direct investments in several industries; investment in infrastructure improvements, and more. A highly visible “Make In India” campaign aimed at converting India into a global manufacturing hub was launched and has attracted over $400 billion in commitments thus far from globally renowned companies. In addition, programs focused on skilling the young and growing workforce and enhancing technology capabilities around the country were also launched.

The past year was undoubtedly the most significant one in terms of needle moving reforms. After years of deliberations, the Goods and Services Tax (GST) Bill was passed. GST will consolidate the various tax structures that exist in India to increase efficiency and boost productivity. Several industry associations predict that this reform (implementation due in July 2017), has the potential of boosting GDP growth rate by 1-2 percentage points.

The Bankruptcy code was overhauled to allow early identification and resolution of financial distress issues and to address structural problems associated with exits for investors more efficiently. The government remains focused on improving the ease of conducting business in India and has taken several steps to reduce the red-tape associated with starting and operating a business in the country.

Sending a rather strong signal about its intent to crack down on tax evasion the government withdrew high-value currency, which amounted to 86% of circulating tender, almost overnight. While temporary disruptions in economic activity due to the cash crunch did ensue, the impact of widening the tax net going forward and moving more transactions to electronic form are likely to enhance growth and enable stronger infrastructure spending going forward.

For the fiscal year ended March 2017, India’s GDP growth is estimated at 7.0% making it one of the fastest-growing major economies in the world. India’s budget deficit has shrunk to 3.5% of GDP from 4.5% three years ago. Foreign direct investment and foreign exchange reserves have reached new peaks. Inflation is less than half of what it was three years ago, and that has enabled the Reserve Bank of India (RBI) to reduce interest rates by 175 basis points in the last three years – making India one of the rare major economies where interest rates are currently falling. As a result of increased capital inflows and strong macroeconomic fundamentals, the Indian rupee has strengthened over 5.5% against the US Dollar since the start of 2017.

A couple of months ago, legislative assembly elections were held in the states of Uttar Pradesh, Goa, Manipur, Punjab, and Uttarakhand and municipal elections were conducted in the states of Maharashtra and Delhi. Coming near the halfway mark in the Modi Government’s five-year term and following close on the heels of the high-profile demonetization exercise, these were widely viewed as referendums on the central government. In nearly all the elections, the BJP improved on its prior performance in the same region; and in some cases, such as the Uttar Pradesh and Uttarakhand legislative elections, won by a landslide, prompting many political pundits to predict that the current momentum will lead the BJP to secure a second five-year term in 2019.

Despite the reduction in interest rates, credit growth has limped along. US $150 billion of non-performing assets (NPAs) on the balance sheets of public and private sector banks have crippled the lending market over the last couple of years. Over the last few years, the RBI has initiated reforms such as allowing debt owed by willfully delinquent borrowers to be converted to equity and insisting on adequate provisioning of bad loans through regular audits which have resulted in sizeable write-offs. However, banking consortiums have been reluctant to move fast enough on haircuts and write-offs in several cases. In an attempt to tackle this issue, which threatens to slow down the country’s growth, the government passed an executive order last week, which gives the RBI greater powers to force resolutions on bad loans. This clean-up of the balance sheets, largely for public sector banks who hold the majority of the NPAs, will be a bitter medicine in the short term for the longer-term health of those institutions and should hopefully, enhance credit growth.

The importance of internal communications

In an ever-connected world, companies are expanding their marketing departments and increasing budgets to communicate with customers across platforms on a 24/7 basis. There is a tremendous emphasis on proactively addressing consumer issues, engaging with customers and responding real-time to external feedback. Unfortunately, in too many instances, the proclivity to encourage internal communication and react expeditiously and efficiently to feedback from within the organization is low. Which, we believe, is shortsighted because strong internal communication leads to higher levels of employee engagement and productivity and lower attrition.

Internal communications is not a one-time, “check the box” kind of event, but rather, an ongoing process, which when done authentically, creates a significant and sustainable competitive advantage in any industry.

To read more, please click here.

News & Updates

SCP Fellowships

SeaLink Capital Partners has a robust Fellowship program to attract and develop high-quality talent.

We are excited to welcome Ayush Gupta as our most recent SCP fellow. Ayush has a Bachelors degree in Electrical Engineering from IIT, Delhi and has worked in quantitative analysis at Goldman Sachs and Quadeye Securities. Following his Fellowship with SCP, Ayush will be pursuing his MBA at IIM, Ahmedabad.

Upcoming visits and conferences

It was great to see many of you at the VCCircle LP summit in Mumbai in March. Over the next two months, SCP team members will be in Singapore (where Heramb will be speaking at the SuperReturn conference), Europe and the US.

If you would like to hear more about SCP, or the investment climate in India, please let us know. We would be happy to schedule a discussion.